A quiet financial revolution is underway. Institutional adoption of blockchain is no longer a question of if, but how fast. Regulated institutions are migrating on-chain as they see the value in action. From real-time settlement to reduced counterparty risk, the case for moving on-chain is clear.

So why haven’t we seen the rapid growth of on-chain capital markets yet? Today’s roughly $22 billion in on-chain real-world assets (on non-Canton) public chains barely scratches the surface when you consider the $500 trillion global capital markets opportunity, or the $2 quadrillion in payments made every year.

The Hidden Barrier: Privacy

The answer lies not in operational capability, but in something more fundamental: privacy.

Imagine that you’re a trader with exposed collateral positions, effectively broadcasting your strategy for competitors to front-run. Or a corporate treasurer managing liquidity, only to find your payment flows becoming visible to the world. Privacy isn’t a luxury, it's a critical requirement for day-to-day financial operations. Without privacy, on-chain finance will not be able to scale. Organizations and their stakeholders need the confidence that the confidentiality (or visibility) of their trading strategies, asset positions, and transactions can be controlled by design.

That brings us to a critical goal for on-chain finance: combining the benefits of blockchain, atomic settlement, and reduced counterparty risk with privacy built for institutional needs. Only then can institutional capital markets move from small pilots to mass adoption.

Firms that have solved the privacy problem are thriving. Take Broadridge as an example. Since deploying their Distributed Ledger Repo (DLR) platform on Canton they’ve scaled from $2 trillion to over $4 trillion in monthly on-chain U.S. Treasury repo financing, enabled by institutional-grade, privacy-preserving workflows on Canton.

The Limitations of Public L1 Chains

Public L1 chains were typically built around transparency where every transaction was visible by default. While this allowed anyone to audit the ledger, it failed to address the confidentiality requirements of regulated finance. This led to the proliferation of L2 chains and alternative solutions that have rushed to patch this problem over with pseudo-privacy solutions, but these solutions lacked auditability, which left systems vulnerable to hidden bug exploits.

Why Canton is Different

Canton Network’s architecture is fundamentally different from any other public blockchain; it has been designed from the ground up with native institutional-grade privacy, without compromising the interoperability of public L1 chains. Instead of radical transparency, where the entire ledger is replicated on every node, Canton’s apps segregate data so that stakeholders only see the details they need. Other stakeholders not involved in a transaction cannot view its details.

2 key Canton principles enable this:

- Sub-transaction level privacy: smart contracts ensure each party only receives and records the parts of a transaction that apply to them, sharing data only on a need-to-know basis.

- Proof-of-Stakeholder: Canton’s consensus mechanisms operate such that only the parties involved in a transaction (the stakeholders) are responsible for validating it. There’s no staking requirement to run a validator node on Canton.

How Canton Powers Real-World On-Chain DvP, with Privacy

For example, in a Delivery vs. Payment (DvP) transaction, where an asset is transferred in exchange for payment, the bank will only see the data for the cash transfer portion of the transaction, and not the underlying securities being transferred. On the other hand, the securities registrar will only see the data for the assets transfer and not the corresponding cash movement.

This selective disclosure on a need-to-know basis is unique to Canton. Unlike other networks, operators of network infrastructure don’t see transaction data, they are only able to see limited metadata needed to ensure ordering and consistency, such as transaction status and the parties involved.

This institutional-grade privacy architecture is why leading financial institutions have confidently adopted Canton to power regulated financial workflows at scale - processing over $100 billion in UST repo transactions per day, more than $15 billion in natively issued securities, and over $4 trillion in on-chain real-world asset volume.

The below example illustrates how privacy is preserved for a DvP transaction on Canton:

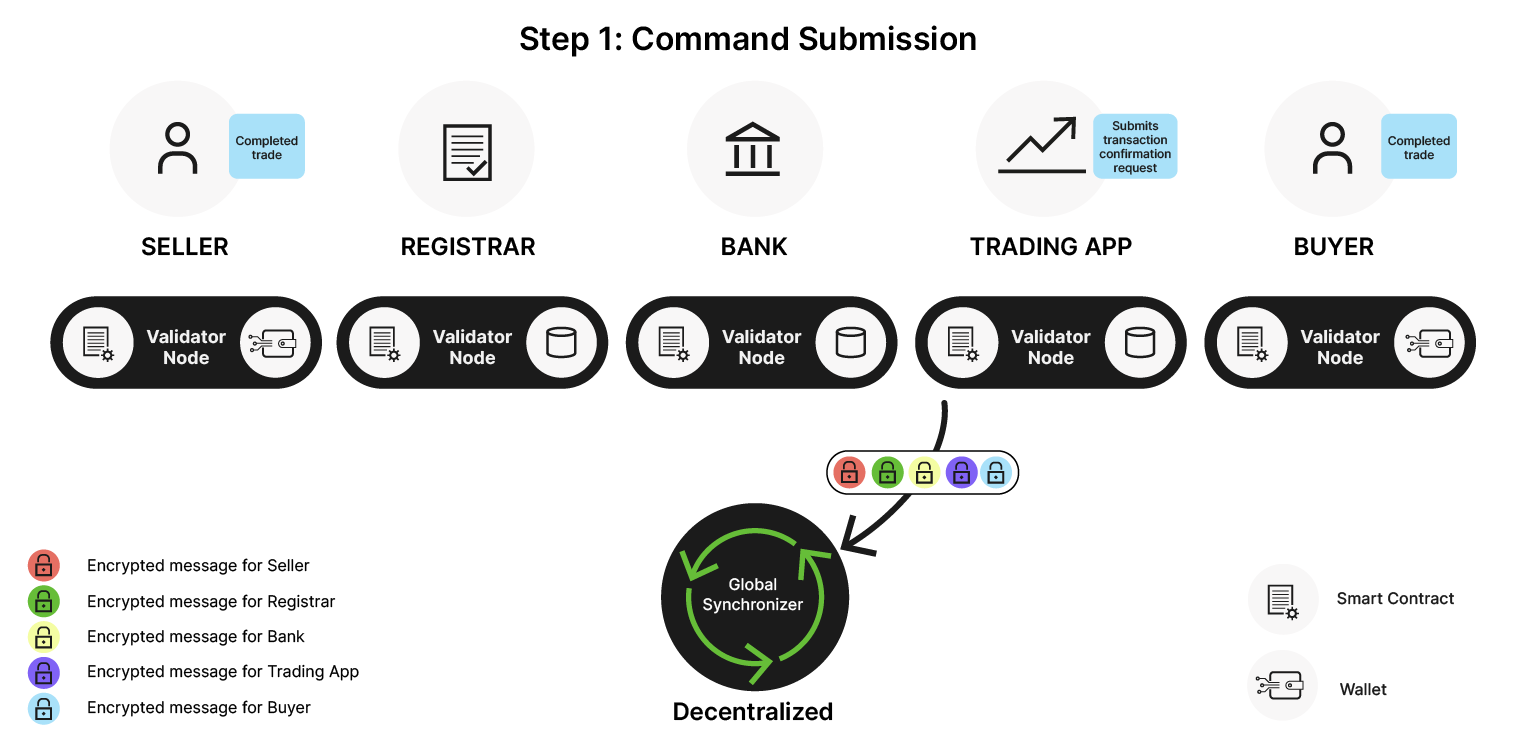

Step 1: Command Submission

After the trade is agreed between the Seller and Buyer, we can perform an atomic settlement.

The Trading App submits a command to settle 100 shares in exchange for $10k.

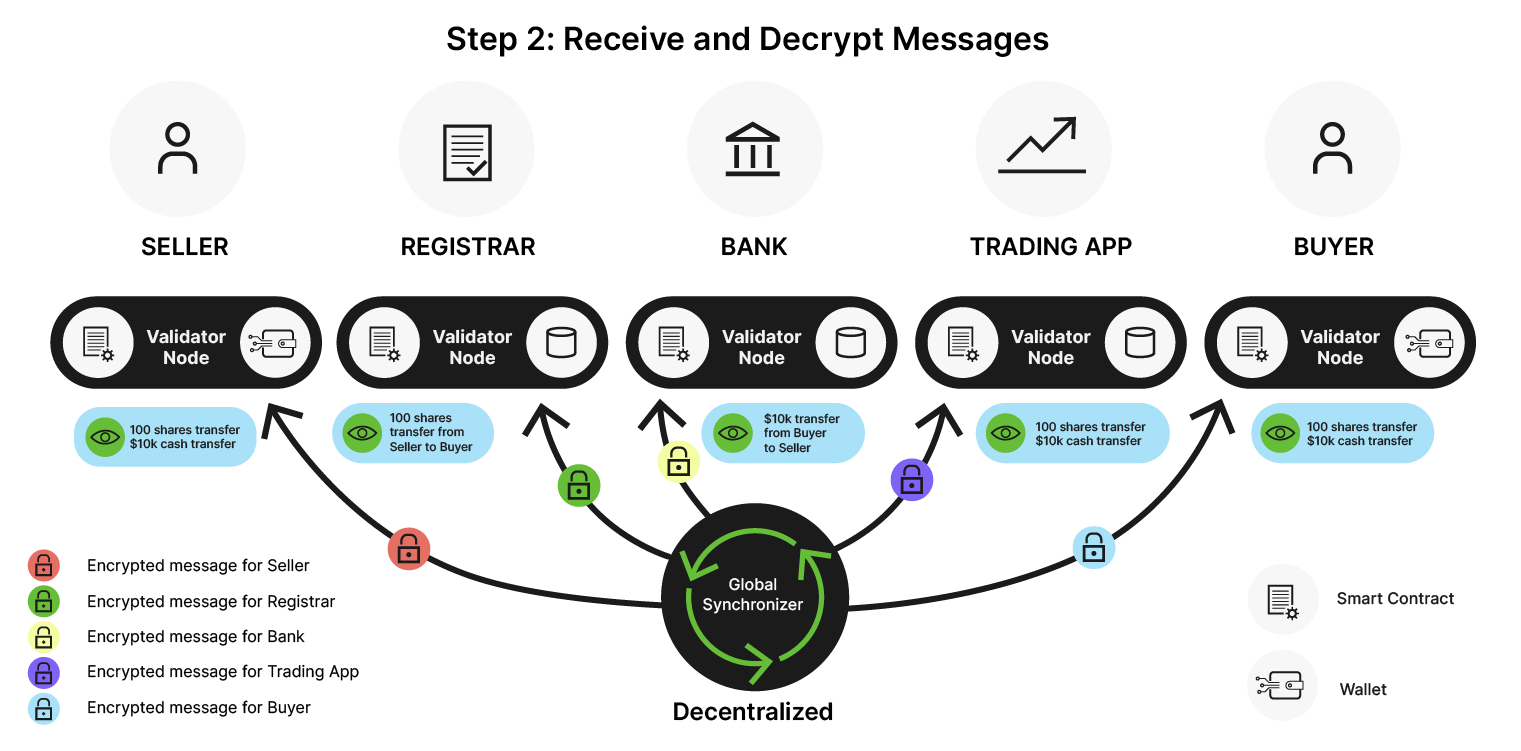

Step 2. Receive and Decrypt Messages

Each validator that is part of this transaction receives their portion of the relevant encrypted confirmation request and decrypts the message.

The Bank will only see the $10k cash transfer, not the underlying shares being transferred.

The Registrar will only see 100 shares being transferred, not the cash movement.

Seller, Buyer, and Trading App see both the $10k and 100 shares transfer.

This selective disclosure on a need-to-know basis is unique to Canton.

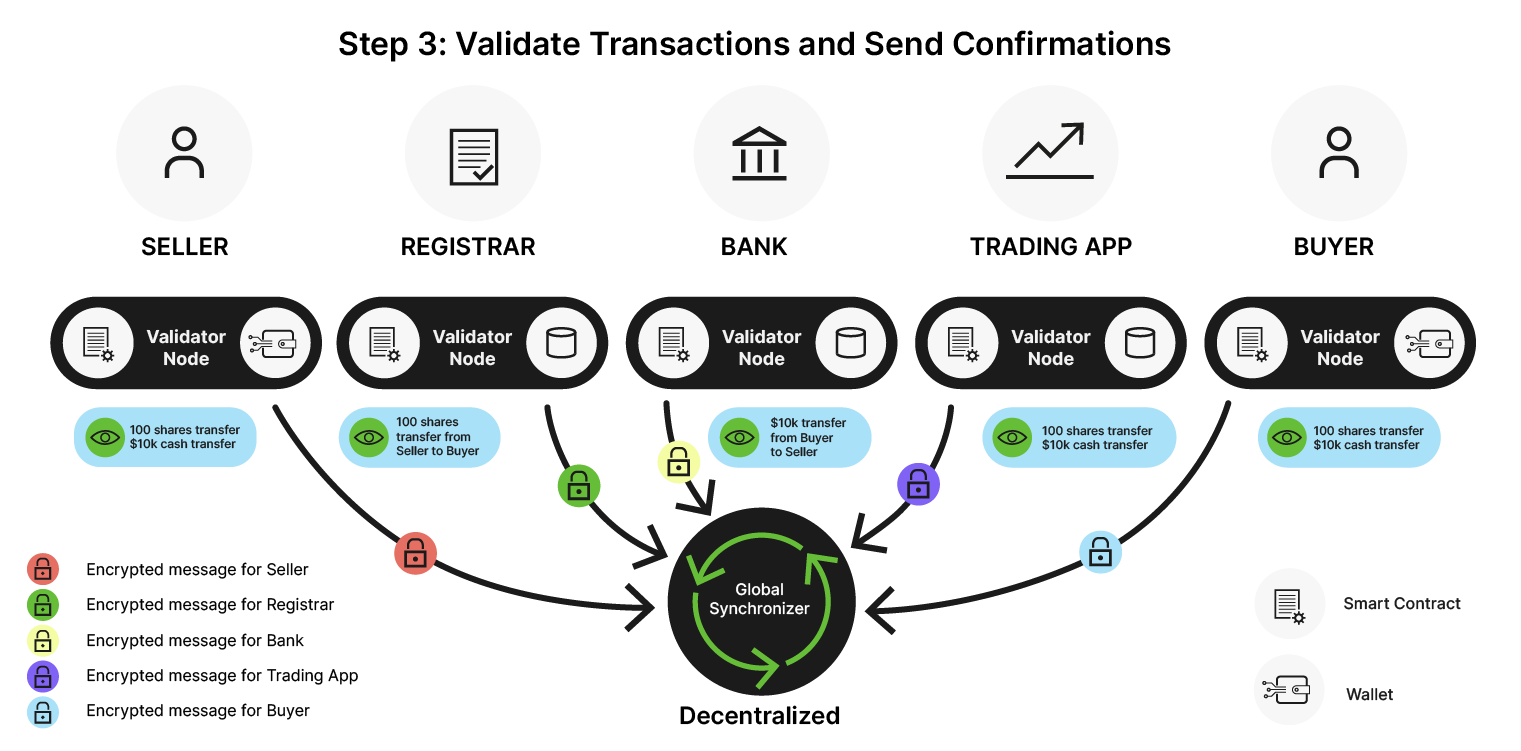

Step 3. Validate Transactions and Send Confirmations

All the participants: Seller, Registrar, Bank, Trading App & Buyer validate the transaction. Each validator node sends confirmations to the Global Synchronizer.

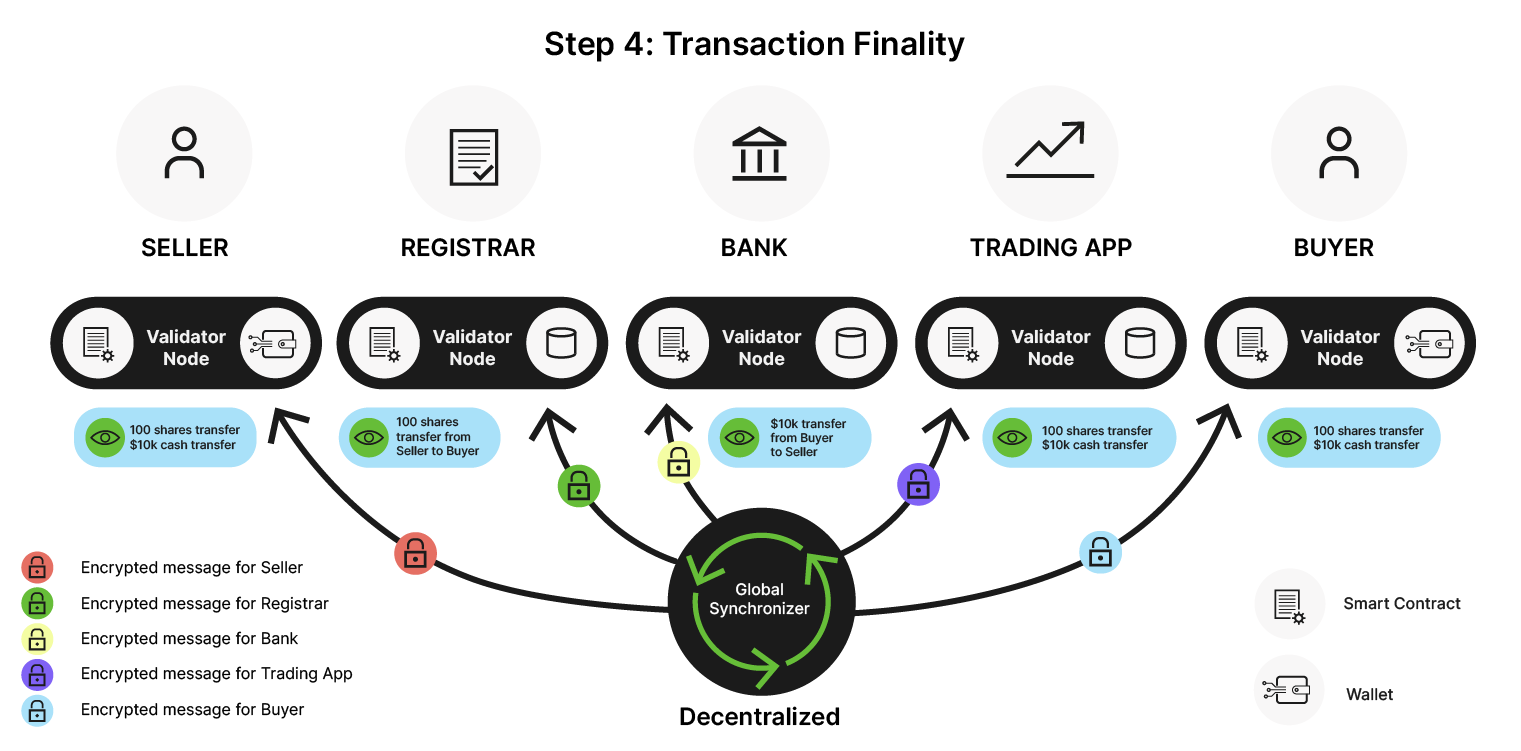

Step 4: Transaction Finality

The Global Synchronizer sends a commit message to the nodes, updating the state for all parties (Seller, Buyer, Bank, Registrar, Trading App). The atomic settlement of the trade is complete.

Ready to start building on Canton?

Take advantage of the latest features in Canton today and start creating highly composable applications for 24/7 on-chain capital markets and payments with institutional-grade privacy: