Canton Network gains momentum: TestNet is now live

by Canton Network - July 27, 2023

Canton Network gains momentum: TestNet is now live

by Canton Network - July 27, 2023

What is the Canton Network TestNet?

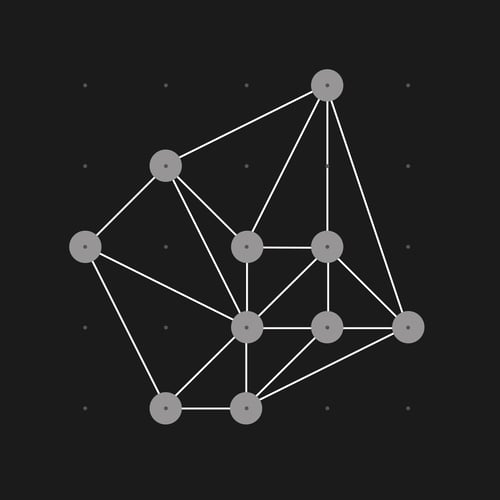

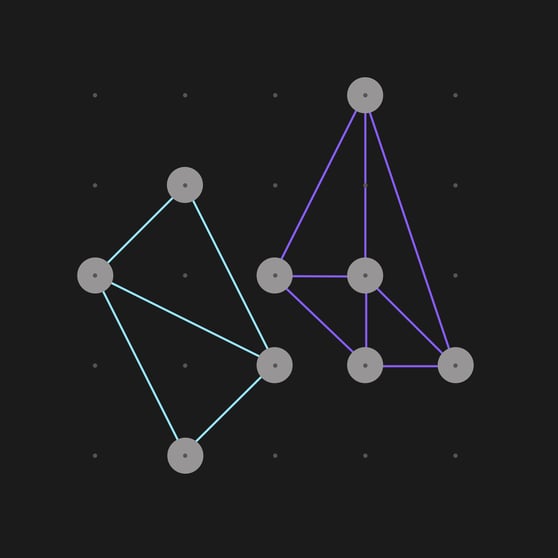

Let’s start with an analogy. The Internet is what it is thanks to four key properties:

- Independent but connected apps. There is a common protocol, but application operators are in complete control of their system—from data permissions to SLAs.

- API composability. Publicly facing APIs can compose together into new experiences on top of the underlying apps.

- Horizontal scalability. The Internet has unlimited horizontal scalability. Each new app and server increases the total network capacity, but no single server or database stores the entire network.

- A browser is the single-point-of-entry. Users have a single point of entry for the entire heterogeneous network of applications.

This is exactly how the Canton Network functions, along with additional critical guarantees like consistency, immutability and privacy. The Canton Network features:

- Sovereign, interoperable apps and blockchains. Each blockchain defines its data permissions into smart contracts and can run its own infrastructure.

- Smart contract composability. Any publicly exposed smart contracts can be composed into atomic transactions across blockchains.

- Horizontal network scalability. Each application can expand the capacity of the network by deploying more supporting infrastructure. Each node only stores its own data.

- A node is the single-point-of-entry. Having a node allows users to connect to any app registered in the network.

When the Internet was built, organizations worked together to lay the foundational infrastructure—from the protocols governing how data is sent and received and the way we discover domains, to the physical routers, servers, switches, and cables that connect the Web today.

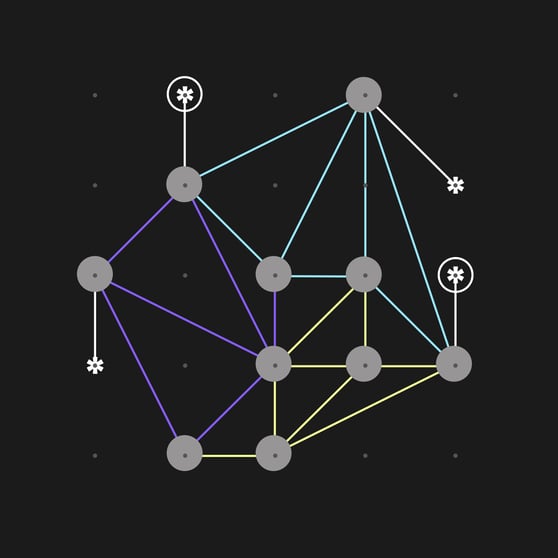

Canton TestNet lays similar foundational infrastructure for the Canton Network. It introduces an independently operated, globally available synchronization domain to participants. This enables the smart contract composability mentioned above (i.e., the ability for smart contract applications to compose atomically across applications). It is now possible to use multiple synchronization services depending on the needs of the use case and the trust requirements of the parties in a transaction, making cross application composability a reality for TradFi.

Early adopter organizations are independently running this decentralized synchronization service and associated network utilities. Since the launch of Canton in May, they have been testing the infrastructure, including the governance mechanisms and network tools, such as the Canton Naming Service, which acts as the address book for the network.

Rewind: Why do we need another blockchain network?

The Canton Network has been designed by financial institutions for financial institutions to provide a different type of network—one that can address the core challenges that still exist with private and public blockchains.

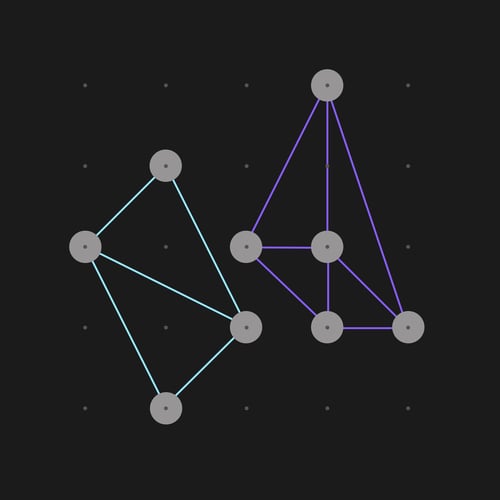

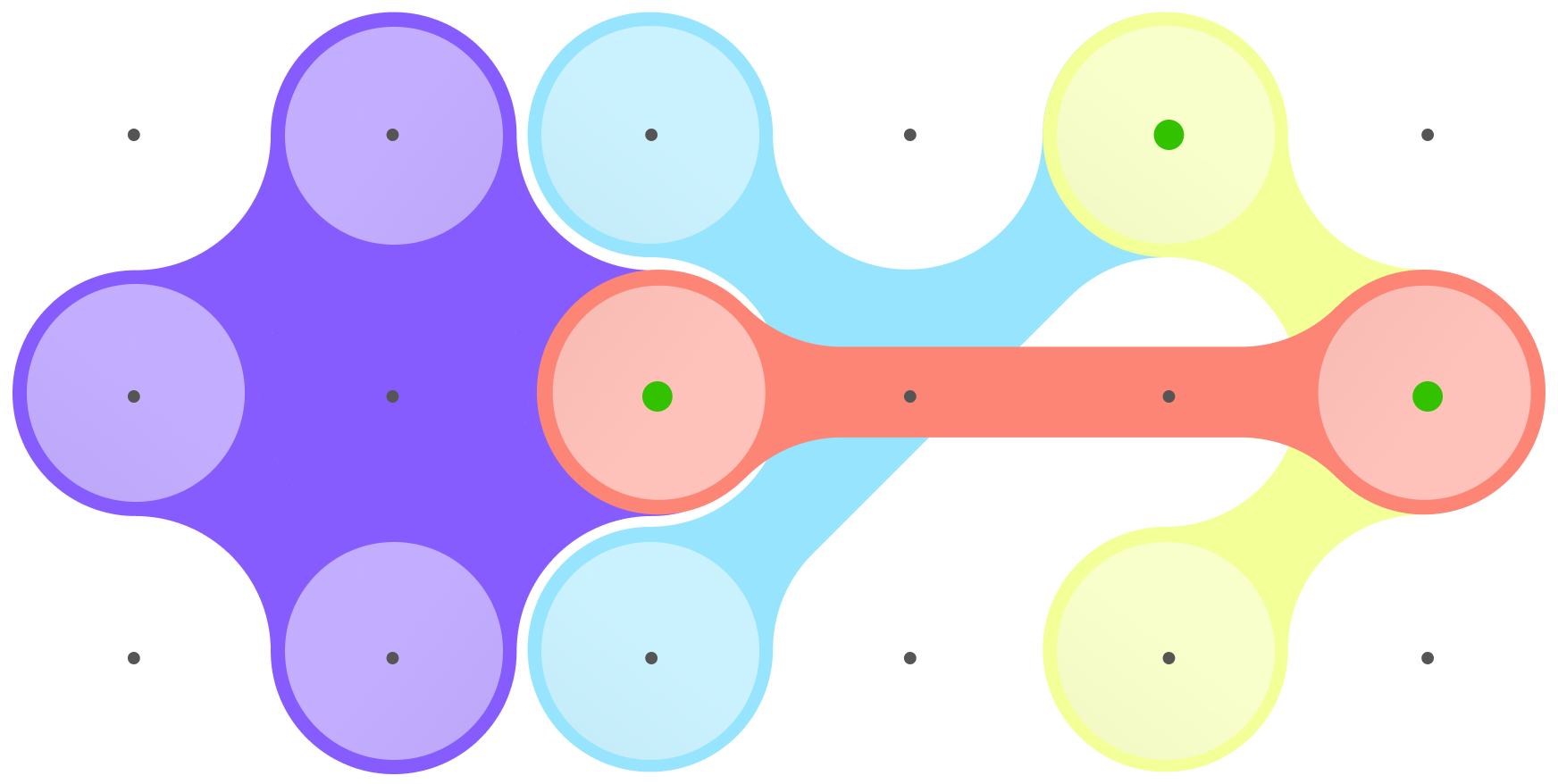

Public blockchains have interoperability, but sacrifice privacy and control

Public blockchains demonstrate the incredible power of interoperability through DeFi but to adopt a public blockchain, operators ultimately are forced to sacrifice control over their application to a pool of shared validators.

This exposes customer data to the world and makes it nearly impossible to meet regulatory and compliance requirements related to the movement of assets across regulated financial markets.

Private blockchains reclaim some control, but reintroduce the interoperability problem

Private blockchains claw back some controls for operators, who can pick validators and permission who can connect to the ledger. When you dive into the detail though, these platforms still don’t resolve the privacy problems of public blockchains.

Worse, there is no such thing as transactional interoperability across the subnets of private blockchains, even if the two applications are using the same blockchain platform. At best, interoperability only exists between applications operating within a walled subnetwork or zone.

Canton: A new way forward

The Canton Network offers both private and globally available network infrastructure, enabling a new way to achieve network interoperability and composability, while still maintaining the data and application privacy and sovereignty financial institutions require.

Complete, independent application control

Native interoperability

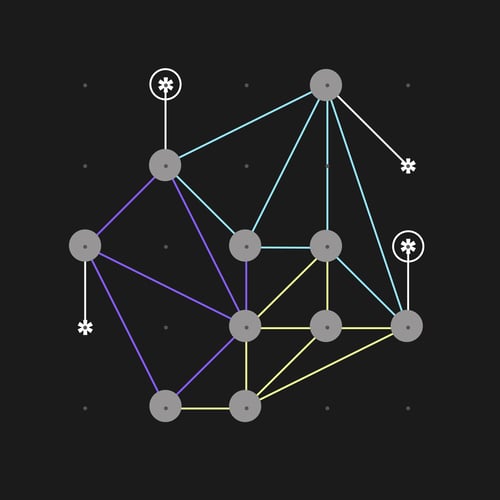

Towards a network of networks fit for TradFi

Public networks and L2s

Decentralized mainframe run by unknown third parties

-

Ledger replicated on all nodes (no privacy)

-

Application control ceded to unknown validators

-

Smart contract interoperability

-

Layer 2s and ZKPs complex/rely on asset bridges

Private islands

Centralized deployments; don't talk to each other

-

Privacy leaks

-

Stranded assets; not interoperable across zones

-

Key use cases (e.g., DvP) only within islands/zones

Network of networks

Sovereign but interoperable apps, like the Internet

-

Fine-grained privacy with highly segmented data

-

Sovereign control over applications

-

Interoperable smart contracts

-

Choose public or private sync infrastructure

Public networks and L2s

Decentralized mainframe run by unknown 3rd parties

-

Ledger replicated on all nodes - no privacy

-

Application control ceded to unknown validators

-

Smart contract interoperability

-

Layer 2s and ZKPs complex/rely on asset bridges

Private Islands

Centralized deployments; don't talk to each other

-

Privacy Leaks

-

Stranded assets. Not interop across zones

-

Key use cases e.g. DvP - only within islands/zones

Network of Networks

Sovereign but interoperable apps - like the internet

-

Fine-grained privacy with highly segmented data

-

Sovereign control over applications

-

Interoperable smart contracts

-

Choose public or private sync infrastructure

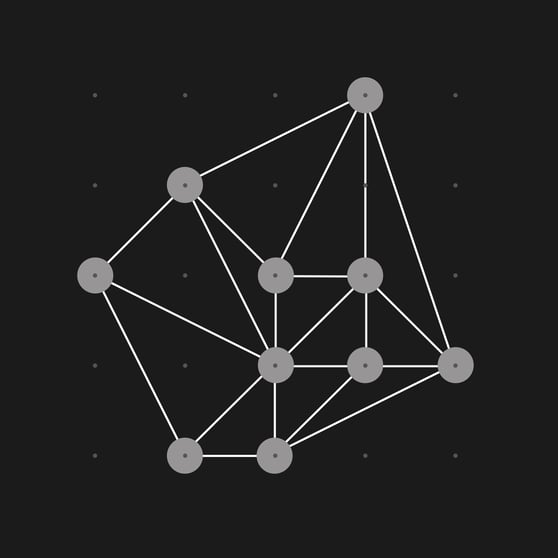

Canton’s aim is to facilitate the organic growth of a ‘network of networks’ that gives institutions the right balance of sovereignty, privacy, and composability, taking inspiration from the most successful network the world has ever seen—the Internet.

With the release of TestNet, Canton Network participants can now access the open infrastructure that facilitates Internet-like composability and control to power synchronized finance and seamlessly transfer value across regulated financial markets.

To learn more about why composability, privacy, and sovereignty are table stakes for traditional finance, watch the recording from our recent webinar with EquiLend.

Multi-domain: Composability without the trade-offs

Take the killer app for blockchain: Delivery versus payment (DvP). Atomically exchanging a digital asset between a participant in one application network with a buyer holding digital cash on another requires interoperability between the two applications. In other networks, achieving this comes at the expense of privacy or with the need to negotiate trust trade-offs.

Now, with the availability of TestNet, two applications on the Canton Network—for example, a securities registry application and a tokenized cash application—can leverage the global sync domain to create the DvP leg of a transaction. Uniquely, it does this by enabling participants to use an independent service outside of the buyer and sellers' applications to enable the atomic swap of assets and cash.

The key to unlock the exponential power of connection

The top 10 leading global investment banks are already participating in private-permissioned blockchains that use Daml and Canton.

These organizations and others using this technology arrange more than 75% of the world's syndicated loans.

$1.5 trillion in repo transactions a month are made using the Canton Network’s underlying technology: The smart contract platform Daml, and its embedded blockchain protocol, Canton.

With TestNet, applications built on Daml and Canton are being connected into an interoperable ecosystem. Banks and exchanges are exploring how the network can be used to build and connect digital securities issuance and registry platforms with asset servicing applications.

Soon we will see digital assets seamlessly connected to secondary market applications—for example, securities lending platforms—to transform risk management, liquidity, and operational efficiency. Other institutions are exploring the value of connecting their applications with providers of cash on ledger, whether in the form of tokenized bank deposits and money market funds, or digital currency.

With Daml and the Canton Network infrastructure now available with TestNet, it’s possible to create and test these scenarios today.

Scenario 2

Intraday repo financing: releasing tokenized cash as collateral for variation margin. Investors could use tokenized bonds held in a bond registry application as collateral when requesting intraday repo financing via the financing application. Investors could then meet variation margin calls using the cash made available by the repo. These were DvP transactions, swapping the digital bonds for tokenized cash.